Iconic Bordeaux producer DBR Lafite just announced the name of its Shandong-based winery, a decade after the project began. I wrote this piece for Wine Searcher about what Lafite and that winery mean for China. Here are a few points about the name that didn’t make the cut.

Lafite’s China winery is named Long Dai. Yes, it sounds like Long Die.

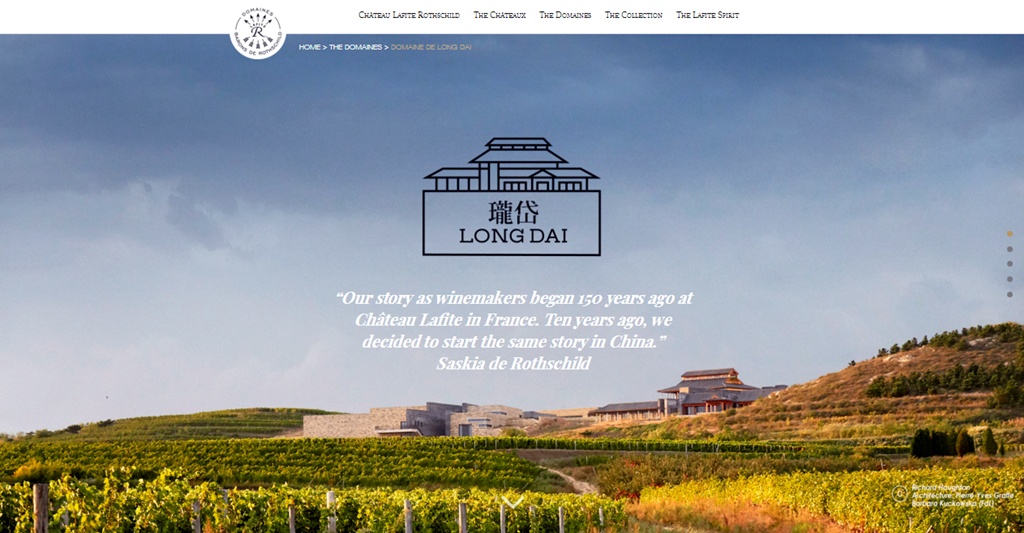

The name is inspired by Taishan, a sacred peak in Shandong province, home of the winery. And represents “an idealized mountain that rose through the power of nature and was then carefully chiseled by human hands.” High-level stuff.

But the first reaction of a Chinese friend, and wine trade veteran, was of surprise.

She immediately associated Long Dai with Dynasty, the big China wine producer. We have both heard people label wines from Dynasty as “Die Nasty“.

Whether or not that is fair is besides the point. (See here for medals won by Dynasty in contests.) The point is a name can open the door for a joke, especially when the key has been turned by somebody else.

(I’m not sure what would happen if you blended Dynasty and Long Dai. They say that life is “nasty, brutish and short”. In that case, it might end up nasty, Cru-tish and with a short finish?)

Anyway, I have a PR solution. Because I assure you, my friend won’t be the last to make this association.

Long Dai / Lafite is in Qiu Shan Valley and close to the myths of Penglai Mountain—said to be home of The Eight Immortals.

“According to the ancient text [Mountains and Seas], Penglai Mountain was an isle of eternal summer in the Bohai Sea, where wine glasses refilled themselves and magic fruits granted everlasting youth,” states state media China Daily.

Self-refilling wine glasses? How appropriate. Sign me up for that club.

With this intriguing back story, “Long Die” can simply be a terse way of proclaiming “immortality”. Or at least “longevity”. Made possible simply by guzzling Lafite wine.

In short: Long Dai –> Long Die –> Live Long –> Immortal.

No need to pay for this advice, Lafite. A six-pack of Long Dai is enough. I will use it for a special Long ‘Die Hard’ movie night with my friends. We can enjoy action movie antics and live forever — or for at least for a very Long time.

And if there is any wine left, then we’ll switch to Star Trek. And ganbei each time Spock says “Live Long (Dai) and prosper.”