[A version of this report first appeared in Grape Wall newsletter. Sign up here.]

As they say, do you want the bad news or the *really* bad news first?

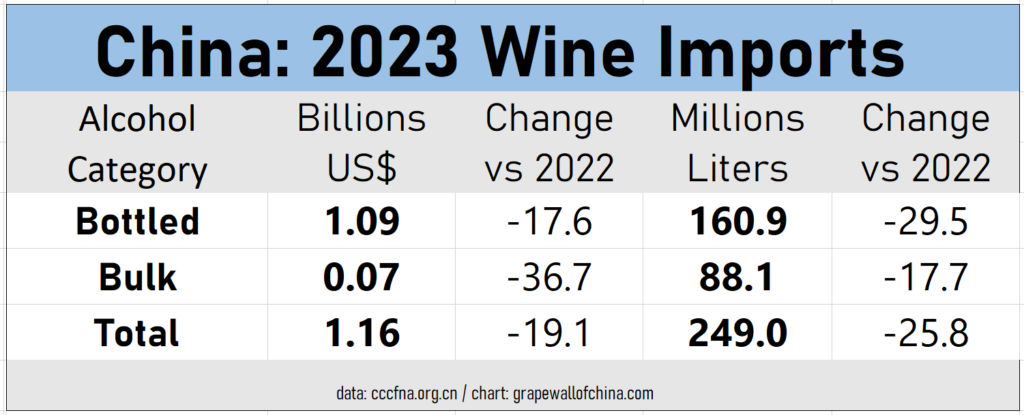

The bad news is bottled wine imports in China fell 17.6% by value and 29.1% by volume in 2023, a year we hoped would deliver a big rebound after three years of ‘zero-COVID’ restrictions from 2020 to 2022.

The really bad news is this crash isn’t part of a similar disaster for imported alcohol in general, as both spirits and beer performed far better, and that underscores that wine faces a particularly serious crisis.

Check out these stats. (The source is CFNA or China Chamber of Commerce Foodstuffs, Native Products and Animal By-products.)

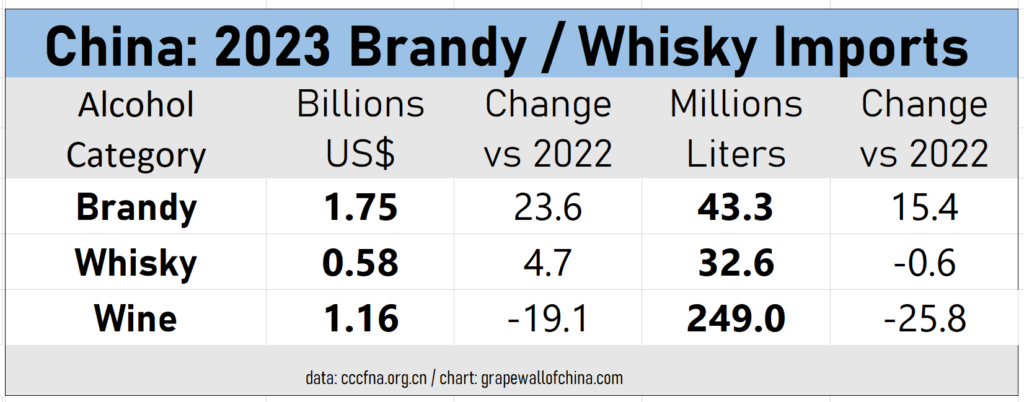

The numbers above show imported spirits and imported wine speeding in opposite directions: the former rose over 20% in value while the latter fell nearly the same amount. (Beer imports also declined, although not nearly as much as wine.)

Imported spirits had more than twice the value of wine, US$2.8 billion versus US$1.12 billion, on half the volume.

It’s also interesting to see how wine fares versus particular spirits niches.

Brandy alone is 50% bigger by value than all wine imports, US$1.75 billion versus US$1.16 billion.

Whisky is more of an eye-opener, reaching US$0.58 billion in 2023, exactly half of wine’s value.

And there are expectations for local whisky to gain more ground. I just wrote a story for Wine-Searcher about how the coming Year of the Dragon might be called Year of the Dram-gon given there are nearly 50 major distilling projects found throughout China. Check it out here.

If we look a little deeper at wine, we see the vast majority of value is in packaged wine, mostly bottles under two liters, with 15 times more value than bulk wine, even if it has just double the volume.

(I wish we had stats on where that bulk wine went. How much is bottled with proper country-of-origin labels? How much is blended with local wines? How much is found under some label such as Chateau LaFeet or Chateau Oats BrieYawn? And so on.)

Anyway, the most-sought stats are for bottled wines under 2 liters, essentially 750 ml bottles, since they represent most packaged wine. For 2023, that means 152.1 million out of 160.9 million liters, worth US$1 billion.

Here are a few numbers that jump out at me, along with some context.

- Billion-dollar question: The reality check here is that Australia was exporting over a billion dollars to China alone during its heyday. And in terms of overall wine value, the numbers for 2023 are just 30% of 2018, while value is only 35%, as I noted in my last newsletter. In other words, those 2023 figures are simply one part of a long slow-motion crash.

- France vs everyone. France is again dominating by value and volume, taking us back to the days before the rise of Australia, when I regularly wrote “France vs Everyone” posts. (For example, in 2013, a decade ago, France had a market share of 46.1% by volume and 47.6% by value.) Unfortunately, gaining market share in a shrinking market isn’t that much fun.

- Double-digit drops. There are many major decreases, including six countries with double-digit value drops, led by Spain, Chile and Georgia, and seven with volume drops, led by Spain, Chile and Argentina. We’ll see if the regional promotion bodies have more than the same-old master classes, trade tastings et al up their sleeves as a response.

- Silver linings. There are a few positives, including minor gains for South Africa and the U.S., though we need a longer timeline to interpret these. Also, a nearly 20 percent boost in New Zealand volume versus a slight decline in value–something tells me this indicates consumer demand for entry-level Sauvignon Blanc.

- Per-liter leaders: In terms value per liter, of the top ten import sources, the leaders were the United States at US$14.7, New Zealand at US$9.9 and France at US$8.8. The bottom three were Spain and South Africa at US$3.6 and Georgia at US$3.7. Overall, the runaway winner was Canada at US$18 — thanks icewine! — though with small volumes.

- Sparkling results: Bubbly remains a small niche at just under US$80 million, dominated by three players with very different value / volume propositions. In 2023, France led the way with US$59.5 million on 1.47 million liters (US$40.5 per liter, thanks to Champagne) while Italy had US$13.8 million on 3.14 million liters (US$4.39 per liter) and Spain had US$2.94 million on .92 million liters (US$3.2 per liter). Minor players include Germany, South Africa and Georgia.

And there is lots more.

But I think what blows my mind most are the numbers for Spain and Italy, with volumes of 15.1 million liters and 13.9 million liters respectively. That means about 1 ml — a single milliliter! — of each per Chinese citizen. Not only is that depressingly low but it really highlights just how few people drink wine here.

Anyway, as usual, take these stats as just one part of understanding China’s wine market.

For one thing, imports do not equal sales. As we saw after the tariffs on Australian wine, there was an enormous amount of Down Under stock in Chinese warehouses, with some still being depleted to this day.

For another, big import losses or gains for smaller wine sources are sometimes due to just one or a few importers. A big shipment of Moldovan wine, for example, that arrives in January rather than December can skew numbers toward one year and have people claiming trends that don’t exist.

Finally, the numbers don’t account for all wine, such as stuff smuggled in from Hong Kong or elsewhere.

In any case, I have a few pressing issues at the moment, but will update this post soon with more stats and comments. I’ll also be posting updates to my LinkedIn account.

Sign up for the Grape Wall newsletter here. Follow Grape Wall on LinkedIn, Instagram, Facebook and Twitter. And see my sibling sites World Marselan Day, World Baijiu Day and Beijing Boyce. Grape Wall has no advertisers, so if you find the content useful, please help cover the costs via PayPal, WeChat or Alipay. Contact Grape Wall via grapewallofchina (at) gmail.com.

Leave a Reply

You must be logged in to post a comment.