(A version of this article first appeared in Grape Wall newsletter.)

Quick quiz: How much bigger is China’s local spirits industry than its local grape wine industry? I often ask trade people this question, especially since Chinese wines have received so much attention during the past decade.

Some say twice as big. Others say five. A few go wild and guess up to ten.

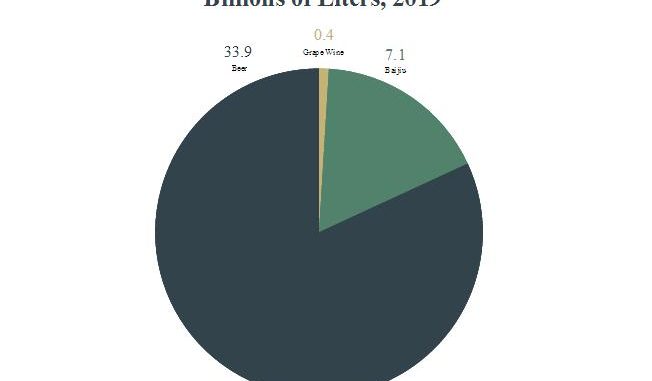

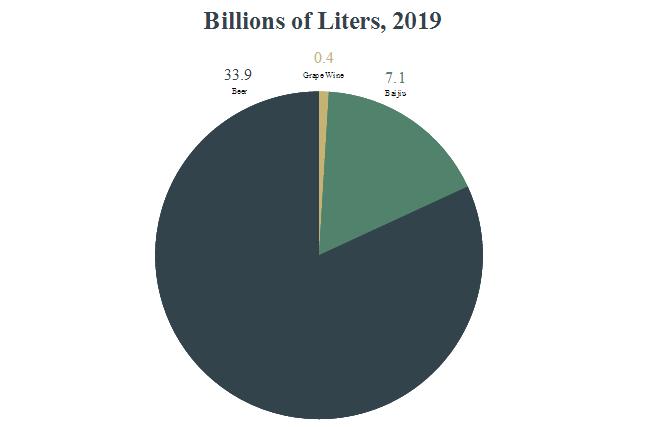

Purely in terms of volume, spirits — meaning that potent firewater ‘baijiu’ — was almost 18 times (1800%) bigger than wine last year. And if you talk alcohol by volume, you could nearly quadruple that to 70 times (7000%), given most baijiu is usually bottled at about 52%.

(Beer is highest by volume. But even there, baijiu is much bigger in terms of alcohol by volume.)

Here’s a wine world equivalent: In 2018, the biggest wine making nation was Italy at 5.48 billion liters, according to OIV. So what nation makes 1/18 of that amount, the same proportion of wine to baijiu? Brazil. (Hungary is close, too.)

Hungary and Brazil do make some nice wines, but for sheer scale, are small players compared to Italy. And so it is with wine in China: it’s a small player in the booze scene..

Wine trade people are usually surprised when they hear about this.

International media coverage of Chinese wine and of baijiu doesn’t reflect the size of those industries. Wine is more familiar for reporters and “relate-able” for readers. And it’s usually of more business interest — the baijiu industry is largely nonexistent beyond China.

Also, people regularly read that China is both a top-ten wine producer and consumer, and it’s easy to assume that means wine is popular here rather than that those numbers simply reflect a huge population.

And maybe some people have visited a sprawling Changyu or Great Wall winery and extrapolated that sheer size to China’s wine market in general.

To be fair, adding imported wine and local production improves the picture — it more than doubles China’s volume of vino — but that still pales versus spirits and beer.

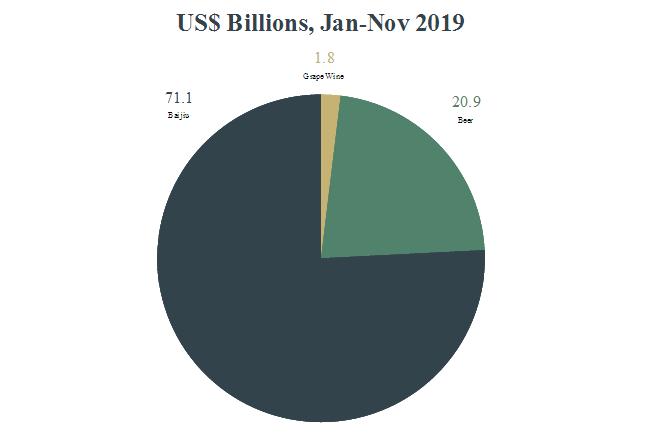

How about value? Wine is also deep in the shadow of baijiu, which had 40 times (4000%) more revenue from January to November last year. Grape wine is much smaller than beer, too. And even gets nosed out by rice wine.

Again, adding imports makes things rosier but doesn’t change the fact that spirits dominate or that big spirits producers are strengthening while wine struggles.

Again, adding imports makes things rosier but doesn’t change the fact that spirits dominate or that big spirits producers are strengthening while wine struggles.

The optimist says this means plenty of room for growth for wine: that would surely be welcomed by a trade that is piling up contest medals as sales and production slowly sink. The realist asks how in the world can the wine trade be struggling versus beer and baijiu when:

- Consumers have more disposable income now than a decade ago, and we so often heard they would upgrade beverage choices, including for wine, once they had more money.

- Chinese have traveled widely, including to places they can easily enjoy wine culture, and we also heard this would boost sales

- The quality of local wine is much improved, with top ones getting good reviews and awards — a thousand-plus thus far.

- China has ranked as a top-three wine education market, at least for WSET, during most of the past decade. Education is the key, right?

- Smartphones and loads of online resources and sales platforms give consumers unprecedented access to wine retailers and wine knowledge.

- Etc.

All this and yet — even well before the coronavirus crisis — sales were down. Production and imports were down. And looking past the “rah rah’ social media posts, the trade’s morale was down — and hasn’t been helped by the disaster of 2020.

Quantifying what is wrong is not easy in a market as vast and (often) opaque as China. Economic uncertainty among consumers, a lingering bad rep for local wine due to sub-par plonk from years past, and the complexity of wine all play roles. But there are other factors to consider, too, and I’ll tackle these in an upcoming post.

Sign up for the Grape Wall newsletter here. Follow Grape Wall on LinkedIn, Instagram, Facebook and Twitter. And see my sibling sites World Marselan Day, World Baijiu Day and Beijing Boyce. Grape Wall has no advertisers, so if you find the content useful, please help cover the costs via PayPal, WeChat or Alipay. Contact Grape Wall via grapewallofchina (at) gmail.com.

Leave a Reply

You must be logged in to post a comment.