This post first appeared in the Grape Wall newsletter I send out about once per month. If you’d like to receive it, go to this link, insert your email address and click ‘subscribe’.

By Jim Boyce | Professor Ma Huiqin and her graduate students at China Agricultural University have partnered with Catholic University and Anakena Winery in Chile the past four years to study the taste preferences of Chinese consumers and then use that data to develop five wines for the market. Ma, who specializes in both molecular biology and wine marketing, explains how the project was conceived and designed, the lessons learned about consumer tastes, and the wines that ultimately made it to market.

On the project launch

I was invited to Chile in 2007 and 2008, for a conference and for a scientific exchange, and I met Gerard Casaubon, who was then working at Catholic University and has since moved to Concha y Toro. We eventually decided to do this project because we all have the same question: do Chinese wine consumers have any specific taste preferences and, if so, how might we discover them?

I approach these projects as a scientist and we need a starting point rather than to just randomly explore tastes. We decided to see what the best-selling wines in China could teach us about consumer tastes. Some people might say these wines are popular due mostly to branding but at the very least the taste is acceptable to buyers.

We asked a group of wine experts to each pick 10 wines they considered best-sellers within a price range of rmb100 to rmb300 in China. That gave us a list of about 30 wines and we selected the sixteen with the most votes.

On testing in China and Chile

Now that we had our 16 wines, we tested them on two groups in China. First, we organized a tasting for 20 experts. They have tried wines across a wide range of prices and have experience judging them.

We also organized a tasting with consumers. We focused on occasional drinkers, those who only have a few bottles per year and only drink on weekends or when gathering with friends. Unlike the experts, consumers find it harder to methodically judge wines, and to describe aromas and flavors in detail, but they do have an idea of what they like.

Both tastings were done blind, and while we were primarily interested in the consumer results, we found a big overlap with the experts in terms of wine preferences. We then sent the 16 wines to Chile, where yet another group tasted them. That gave us tasting data from three groups.

Our next step was to deconstruct these wines. We did GC-MS (gas chromatography-mass spectrometry) and GC-O (gas chromatography-olfactometry) for a basic analysis of aromas, residual sugar levels, acidity levels, tannin and more. For example, we tested the level of whiskey lactone, guaiacol, vanilla and other key flavor and aroma compounds of these 16 wines. With data from these tests, and the tastings, we had an idea of what qualities were preferred by the tasters.

On fine-tuning the wines

We used our data to group the wines into different categories. Some were fruitier, some—two or three of them—had a kind of dry vegetable flavor, and so on. We were now ready for the next stage, to use Chilean wines to blend prototypes using our tasting results and chemical analysis as a reference.

The Chilean side made five prototypes, and sent the base wine to China, where Li Demei [a professor and winemaker] blended four more. Now we had nine samples for our second round of tastings in China, one with a group of more than 20 wine experts and one with a much larger group of consumers—more than 100—than the first time.

We also did brand testing, to see what kind of labels were considered more attractive or associated with expensive wines. We did these tests online and at retail outlets in China.

On the lessons learned

The Chinese consumers who attended our tastings generally liked quite fruity wines, but not fruit bombs. They liked relatively mild tastes, but not too much acidity or harsh tannins. A ‘juicy’ character was also seen as very important.

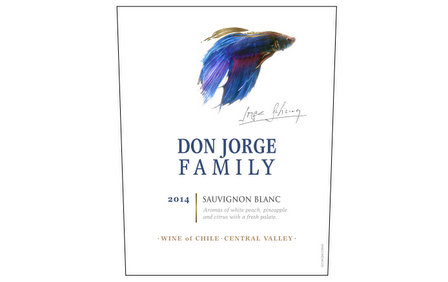

In terms of labels, it’s hard for Chinese consumers to remember imported wine brands or even Chinese brands beyond Great Wall and Changyu. That makes easy-to-remember labels important. We tested labels with images of trees, people and vineyards, among others. We looked at contrasts, such as simple versus detailed, traditional versus contemporary, and muted colors versus vibrant colors.

In the end, and for the price range we sought, most people liked the label with a blue fish. While the fish is not connected with wine at all, it is easy to remember. Chile also has a long coast and is famous for fish, so maybe there is something to the idea!

I should note that when we talk about consumer taste preferences in China, we can’t pick a single flavor or style or label. What we are doing is finding a range. If you take 100 human faces and ask people which ones they consider most attractive, you won’t find everyone likes the same person, but you can find a general range most people prefer. That’s what our research aimed to do for wine.

On going to market

After all this work, we were ready to market the wines and we handled them just like anyone else coming to China. We registered the brand, printed the back label, imported the wines from Chile, and decided on prices. We had two-entry level and three reserve-level wines, including two white—Sauvignon Blanc and Chardonnay—and three reds.

If you only do a tasting and it’s free, people tend to give relatively positive remarks. But to see if people will really spend money, you need to put them into the market. We imported more than 600 bottles and they are doing pretty well. We have sold almost half and are collecting consumer responses as to whether or not they like them.

Our project is a good example of how to do a market study on a scientific level. From a starting point of looking at the best-selling wines, we have come full circle to put our own products in that market, using labels and blends based on our research. It’s a bit like an incubator. The best part is our research not only contributes to the pool of knowledge but also leads to practical results in terms of actual sales and consumer enjoyment.

Check out the online China Wine Directory. And get the free Grape Wall e-newsletter by signing up below.

Sign up for the Grape Wall newsletter here. Follow Grape Wall on LinkedIn, Instagram, Facebook and Twitter. And see my sibling sites World Marselan Day, World Baijiu Day and Beijing Boyce. Grape Wall has no advertisers, so if you find the content useful, please help cover the costs via PayPal, WeChat or Alipay. Contact Grape Wall via grapewallofchina (at) gmail.com.

Leave a Reply

You must be logged in to post a comment.