By Jim Boyce

France versus Everyone. That scenario figures heavily in the year-end stats for wine imports in China in 2013.

The overall results from Customs are sobering. Volume rose 5 percent – largely during the first six months – a far cry from recent years that featured jumps of 50 percent or more. The splash of cold water is that value grew a mere 0.5 percent. And the slap in the face is that value per case fell 4 percent. Fell! It seemed a law of nature that numbers only rise in China.

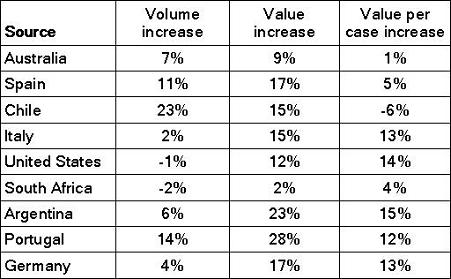

This probably all sounds pretty bad, except that when you isolate the figures for France, things actually looked pretty good. Here are the numbers for the remaining top-ten sources of imported wine: they represent about half of market share.

Nearly every number is in the black. Almost everyone saw volume rise in 2013, with three sources seeing double-digit growth. The numbers for value are even better as everyone made gains, including seven of nine in double digits. In turn, that translated into almost everyone also rising in terms of value per case, although this positive news begs the question: How, then, did the overall number end up in the red?

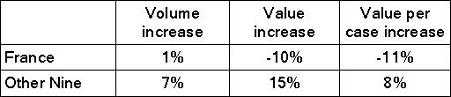

Because France is the heavyweight champion of wine imports in China. Its imports are nearly equal to those of all other countries combined. Thus, if the French numbers say jump, the spreadsheet says how high, and vice versa. Check it out:

Quite a contrast. When the other nine countries are considered, the numbers are close to 2012, which saw growth of 10 percent by volume and 16 percent by value. With France included, they even out to 5 percent rise by volume, a tiny increase by value and that 4 percent decline in value per case.

So, why did value drop so much for France? Maybe, just arguably possibly maybe, because the government crackdown on official spending hammered lots of pricey French wine. That certainly helps explain why volume rose slightly (French wine has cache in the market at large) but value plummeted (many people who were buying the really expensive stuff now can’t).

This isn’t to knock France. Even after a somewhat tough year, it still has about as much market share by value (46 percent) and volume (48 percent) as everyone else combined and it continues to drive the scene.

Anyway, those are just a few rough observations and I’ll try to post more later this week.

(Big hat to tip to Tempranillo.)

Note: I’m sending out new issues of the free Grape Wall e-newsletter soon. If you’d like to receive it, simply go here, stick your email address in the form and click “Subscribe to the list”, or send me an email at grapewallofchina (at) gmail.com

Sign up for the Grape Wall newsletter here. Follow Grape Wall on LinkedIn, Instagram, Facebook and Twitter. And see my sibling sites World Marselan Day, World Baijiu Day and Beijing Boyce. Grape Wall has no advertisers, so if you find the content useful, please help cover the costs via PayPal, WeChat or Alipay. Contact Grape Wall via grapewallofchina (at) gmail.com.

Leave a Reply

You must be logged in to post a comment.