By Jim Boyce

Has China’s high-speed growth in bottled wine imports hit a road bump? First-quarter data from China Customs and talks with four industry players suggest we are seeing a slowdown. I just wrote about this for Meininger’s Wine Business International: read the full story here. Here are a few key points:

- Compared to the first quarter of 2011, bottled wine imports grew 15 percent by volume, ~10 percent by value per case and ~28 percent in overall value (which combines increased volume and value per case) in the first quarter of 2012.

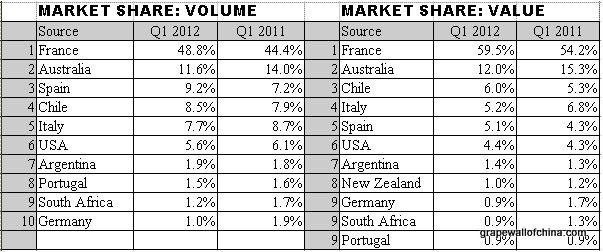

- France again increased its market share both in terms of volume (now just under 50 percent) and value (just under 60 percent).

- Australia continued to slide in terms of share by volume, although it remains in second spot, but has high value per case, trailing only New Zealand and France.

- Spain saw the biggest quarter-on-quarter growth, though it also has the lowest value per case of the top ten import nations.

That 15 percent volume growth is what many people will be talking about. In any other market, it would be reason for importers to pop some Champagne, but China is used to far higher numbers. The question is whether it means the market is slowing — and we are talking about slowing, while still growing, not about any “bursting bubble”, at least not just yet.

There are several possible reasons to suspect a slowdown, although the numbers might be impacted by Chinese New Year falling earlier this year than last and thus by imports arriving prior to the first quarter. Those reasons include overall economic uncertainty; the possibility of a congested “pipeline” of stock for new distributors, retailers, hotels, restaurants, and so on, particularly in the so-called “second- and third-tier cities”, and an excess of stock in China due to thousands of inexperienced importers who are able to get wine into China but unable to sell it. On this last point, Patricio de la Fuentes-Saez of Links Concept has been emphatic for years that a great deal of wine — up to 30 percent, he says — ends up in such hands.

In any case, for more on this, including insights from Alberto Fernandez of Torres China, Campbell Thompson of Wine Republic, Thomas Jullien for Bordeaux Wine Council, and Lucy Anderson of Wine Australia, check the link. (I also contacted some of my local acquaintances re this situation, but because of schedules was unable to get responses before my deadline, so I’ll aim to include their views in a later post here.)

Finally, here are the market share leaders by volume and value:

See also:

- China Bulk Wine Imports 2011: Spain tops Chile, Now Biggest Source

- Va-va-vroom! China wine imports this year: France continues to race ahead

- China wine imports 2010: France spanks everyone (again)

(Hat tip to MLP)

Sign up for the Grape Wall newsletter here. Follow Grape Wall on LinkedIn, Instagram, Facebook and Twitter. And see my sibling sites World Marselan Day, World Baijiu Day and Beijing Boyce. Grape Wall has no advertisers, so if you find the content useful, please help cover the costs via PayPal, WeChat or Alipay. Contact Grape Wall via grapewallofchina (at) gmail.com.

Leave a Reply

You must be logged in to post a comment.